Dynamic Consent - Lead Generation For One To One Consent

Disclaimer: On January 24th, 2025, the FCC’s one-to-one consent rule, which required lead generators to obtain direct consent for each seller before contacting consumers, was struck down by the U.S. Court of Appeals for the Fifth Circuit. This means that, as of now, the rule is no longer in effect. However, businesses should continue to follow existing TCPA regulations and stay informed about any further legal developments or enforcement actions. This is not legal advice—please consult with a qualified attorney for compliance guidance. Please see this blog for more information.

From The Beginning - What Was Going On With The FCC In 2023?

The FCC sought to close the "lead generation loophole," which would have had a significant impact on the lead generation industry. They were trying to help consumers combat robocalls and spam texts mainly through stricter consent requirements. It meant ensuring that one-to-one consent is obtained for each seller, which is a significant shift from previous practices. You can learn more about the specifics of the struck-down ruling here.

What Is Dynamic Consent?

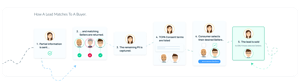

Dynamic consent is a way to easily get one-to-one consent before contacting leads. What is dynamic consent? "Dynamic consent is the ability to return potential service providers to the consumer, allowing them to select who gets their information." Dynamic consent even allows you to keep using ping post in your strategy, read more about that here.

What Solutions Do You Have For One To One Consent?

boberdoo has 4 different solutions that you can customize to your lead flow:

Click-through traffic, Dynamic consent widget, Form Builder with dynamic consent, Ping Post with APIs

What Does This Mean For The Lead Generation Industry?

Although the FCC’s proposed regulations did not move forward, the discussion around one-to-one consent and lead transparency has still left a lasting impact on the industry. The debate emphasized the importance of clear, consumer-approved connections between leads and sellers, a concept many companies have already started preparing for.

Even without a formal ruling, the momentum toward better compliance, cleaner data, and consumer trust isn’t going away. Dynamic consent continues to be a best practice because it ensures each lead explicitly agrees to be contacted by specific companies, improving both compliance posture and lead quality. This proactive approach positions businesses to stay ahead of future regulations and evolving consumer expectations.

If you were preparing for the FCC changes, keep going; the steps you’ve taken still strengthen your operation, protect your brand and enhance transparency with buyers and consumers alike.

Why Was The FCC Pushing To "Close The Lead Generation Loophole"?

The proposed ruling may have felt harsh, but it stemmed from real issues within the industry. Bad actors have inundated consumers with unwanted calls and texts, sometimes hundreds in a single day, resulting in frustration and distrust. The FCC’s attempt to close this “lead generation loophole” was meant to hold the industry to a higher standard.

Although the ruling didn’t pass, the message was clear: the industry needs to self-regulate and prioritize quality, consent and consumer trust. Companies that continue to adopt transparent consent practices now will be better prepared for any future regulatory changes and will stand out to both consumers and partners as trustworthy and compliant.

Webinars

We joined ActiveProspect on their one-to-one consent webinar series, and provided a checklist for lead buyers and sellers that you can watch here. View and download our one-to-one checklist for lead buyers and sellers here.

We also have a detailed walkthrough for the different options you can do with one-to-one consent, especially when working with resellers or brokers.

We hosted a webinar discussing the common questions we've gotten about the FCC, Dynamic Consent, One to One Consent and everything else around those subjects, you can check out the recording here. Also if you would like to join our webinars in the future, you can sign up here.

FAQs

The dynamic consent processing logic moves upfront, where distribution logic occurs before consumers are presented with leads. Behind the scenes, there are three main processing logics:

- sorting by best price

- best expected revenue per display

- weighted logic for priority distribution

The effectiveness of what you can do varies significantly across different industries. However, having additional options does present an opportunity to enhance revenue. By optimizing lead forms to highlight the advantages of choosing multiple companies or sellers, businesses can increase the value they derive from each lead. When consumers are presented with options that closely match their needs, they're more likely to select multiple partners, increasing the average revenue per lead. This scenario mainly benefits lead generators who can effectively communicate these benefits.

The importance of testing cannot be overstated in this context. Some clients have reported poor results, experiencing significant drop-offs when consumers are faced with these additional choices. However, other clients have found success, applying the 80-20 rule where a majority select the first option, but a significant minority opts for multiple partners, leading to increased matching and potentially higher conversion rates.

Resellers still provide significant value to the industry. For lead generators, they provide access to aggregated demand through one consistent API. For lead buyers, resellers provide access to supply that they would not otherwise be available. Resellers also help to weed out bad publishers.

The essence of this challenge lies in the inevitable drive toward efficiency within any marketplace, which often leads to a reevaluation of intermediary functions. For resellers, the path forward involves strategically emphasizing adding value to the transaction process. This can be achieved by understanding lead origins and the intricate relationships that define the lead generation ecosystem.

Historically, lead sources have engaged with many sub-identities or publishers. While resellers have played a key role in optimizing lead flow, there's been a hesitancy to communicate optimizations back to the lead generators. However, as market dynamics evolve, the importance of such communication is becoming increasingly apparent. By managing the nuances of account management, refunds, and day-to-day operations, resellers offer substantial benefits to lead buyers, particularly the smaller ones who might otherwise be overwhelmed by the complexities of direct dealings.

The value proposition of a reseller extends beyond mere transaction facilitation; it encompasses the management of relationships with lead generators, thereby acting as a bridge between the generation and the consumption of leads. While currently vital, this role faces the risk of becoming redundant over time as direct partnerships between lead generators and buyers become more common. The challenge for resellers is continuously evolving to offer services that justify their position in the lead transaction process.

The core issue revolves around the potential underutilization of consumer interest. Suppose a consumer expresses a preference for multiple sellers. In that case, an opportunity exists to capitalize on this by facilitating transactions with each selected seller, thereby maximizing revenue. This approach aligns with the principle of leveraging consumer intent. It introduces a dynamic aspect to lead distribution, shifting the focus towards optimizing revenue opportunities through strategic seller selection.

Furthermore, this scenario prompts a reevaluation of existing lead distribution mechanisms, especially in cases of post-rejection by buyers. The efficiency of allocating space to sellers with a high rejection rate is scrutinized, as it could potentially limit revenue generation. The argument leans towards prioritizing sellers demonstrating a higher acceptance rate for leads, even if their bid might be lower, as this could result in a more consistent revenue stream.

The challenge lies in processing logic that respects the one-to-one consent framework and optimizes revenue by intelligently managing lead allocations. This requires a delicate balance between adhering to consent rules and maximizing the economic potential of each lead, urging lead generators and sellers to revisit and refine their operational strategies in light of these considerations.

The short answer is yes, there is a workaround that doesn't necessitate rebuilding all live forms from scratch, but this solution comes with its considerations.

With boberdoo form builder, You can create specific forms to only display the "final step" for the consumer, allowing you to maintain your current flow and add on the one-to-one consent at the end.

The concern is valid: when consumers are presented with company names, they might bypass the lead generation system by directly searching for these companies on Google. Integrating multiple monetization opportunities within the response is the solution to mitigate this and ensure the lead generation effort remains monetizable.

One effective solution is the utilization of trackable communication methods. For instance, providing a trackable phone number through platforms like boberdoo allows the lead generator to direct consumer interactions (calls or texts) effectively. This method not only simplifies the process for consumers, potentially increasing engagement rates but also makes each interaction monetizable, regardless of whether it results in direct lead conversion.

Additionally, leveraging web-based interactions offers another layer of monetization. By including links to the company's website or a specific landing page within the response and making the act of clicking these links a billable event, lead generators can capture value from the initial research phase of the consumer journey. This approach encourages the consumer to use the provided links for research, which can be more convenient than conducting a separate Google search and allows the lead generator to benefit financially from these actions.

Implementing these strategies allows for the monetization of both direct interactions and preliminary research activities by consumers, effectively turning potential free advertising scenarios into revenue-generating opportunities. This aligns with the goal of maximizing the value of each lead and enhances the overall efficiency of the lead generation process.

When a lead cannot be matched with one-to-one consent partners in real-time, the question arises: what next steps can be taken to comply with consent requirements and ensure the lead is not wasted?

The reprocessing of leads, especially in the context of non-one-to-one consent partners, requires a nuanced approach. Initially, when a lead is submitted and fails to match specified sellers, or if a buyer rejects the lead post-submission, the lead generator is at a crossroads. One strategy involves redirecting the consumer to a confirmation page equipped with a widget to display a new set of potential partners, inviting the consumer to grant consent once again.

On the other hand, the introduction of dynamic consent options in the boberdoo Form Builder represents a significant evolution in handling unmatched leads. With the upcoming release of new form builder capabilities, lead generators will have the flexibility to define specific actions for leads that find no matches during the ping process. This includes the possibility of directing these unmatched leads towards "click only" buyers, effectively creating an opportunity to monetize leads that would otherwise remain unprocessed.

The system will offer settings to manage exclusive versus non-exclusive matches, enabling lead generators to tailor the consumer's experience based on the type of consent and match sought. This could involve embedding the information of an exclusive match within the TCPA (Telephone Consumer Protection Act) text or presenting multiple partners to the consumer for selection.

By leveraging these new tools and options, lead generators can take on the challenges of unmatched pings with greater flexibility and effectiveness, ensuring that the opportunities for reprocessing leads remain effective and compliant with consent frameworks.

A significant portion of calls handled by aggregators originates from outbound efforts by call centers. These outbound calls are designed to initiate consumer engagement, which, when successful, results in an inbound call that can then be routed or sold through the aggregator's network.

Understanding the source and nature of these calls is important to pay attention to, especially those coordinating with multiple call centers. It's not just about routing calls but also the quality and compliance of these interactions. This requires a deep dive into the origins of the calls and a comprehensive vetting process for any new vendors or call centers entering the system.

The emphasis here is on transparency and accountability, as aggregators must prove that the consumer experience through these call flows adheres to regulatory standards and ethical practices. Establishing a vetting process enables aggregators to document and understand the consumer journey to check that the calls they buy and sell are generated in a manner that respects consumer rights and preferences. This approach safeguards the aggregator's operations from potential compliance issues. It will also enhance the quality and reliability of the service they offer buyers and sellers within the call aggregation ecosystem.